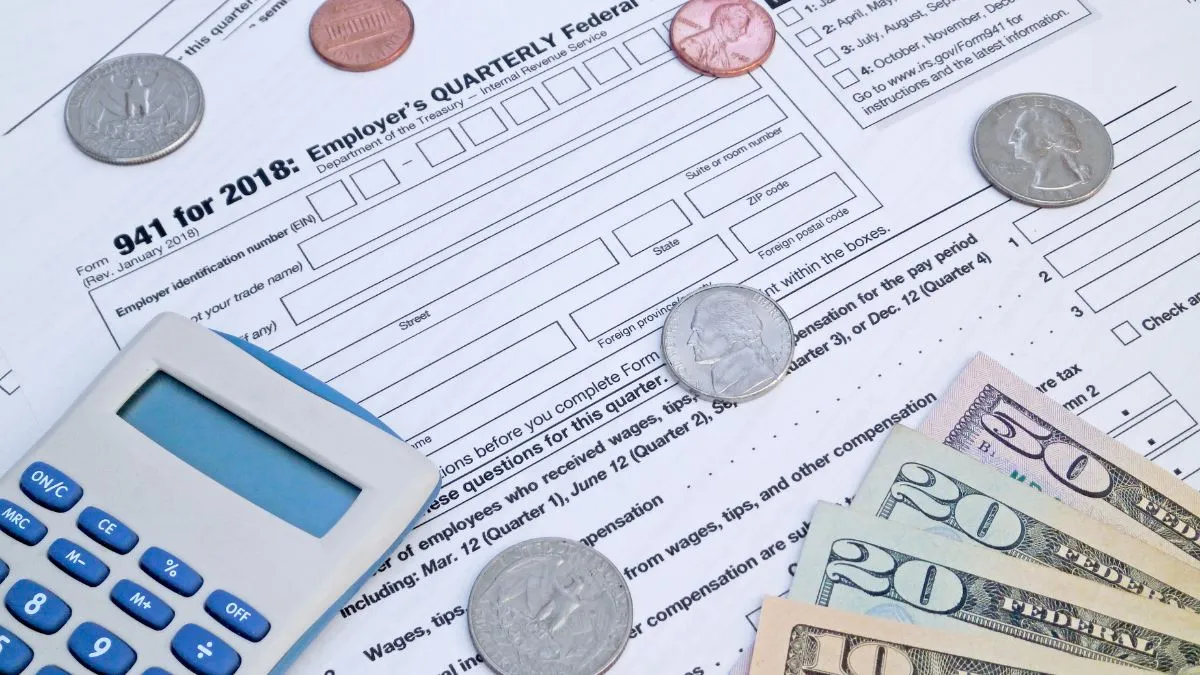

It is useful to have your bank account and routing numbers when using tax preparation software to indicate where tax refunds should be sent.

Having your bank account and routing numbers readily available when using tax preparation software can save you a lot of time and hassle. These pieces of information are crucial for the tax filing process, and not having them on hand can cause delays in receiving your tax refund or even result in errors on your tax return.

In this article, we will delve into why it is essential to have your bank account and routing numbers when using tax preparation software, how to find them, and the benefits of e-filing.

The Importance of Bank Account and Routing Numbers in Tax Preparation

As tax season approaches, many taxpayers turn to various methods to prepare and file their taxes. Some may choose to hire a tax professional, while others prefer the convenience of using tax preparation software. Regardless of the method chosen, one crucial piece of information required is your bank account and routing numbers.

So why are these numbers so important?

Direct Deposit for Tax Refunds

One of the main reasons why having your bank account and routing numbers is crucial for tax preparation is to receive your tax refund through direct deposit. Direct deposit has become a popular method among taxpayers, with approximately 79% of refunds being sent this way in the previous tax season according to the IRS.

Direct deposit offers several advantages over traditional paper checks, including faster refund processing and no risk of a lost or stolen check. The IRS also states that direct deposit is safer, easier, and more convenient for taxpayers.

When using tax preparation software, you will be asked to enter your bank account and routing numbers to indicate where you want your tax refund to be deposited. This information is securely transmitted to the IRS, ensuring the safety of your personal and financial information.

Accuracy of Tax Return Information

Another critical reason why having your bank account and routing numbers on hand when using tax preparation software is essential is to ensure the accuracy of your tax return information.

These numbers are used to validate the legitimacy of your bank account, which in turn verifies that you are the rightful owner of the account.

In case of any discrepancies in your tax return, having the correct bank account and routing numbers can help prevent delays in receiving your refund or even potential issues with the IRS. It is crucial to double-check these numbers before submitting your tax return to avoid any errors.

How to Find Your Bank Account and Routing Numbers?

Now that we understand the importance of having your bank account and routing numbers when using tax preparation software let’s discuss how to find this information.

Bank Statements

The most common method of finding your bank account and routing numbers is through your bank statements. These documents typically list all the necessary information needed for direct deposit, including your account number, routing number, and even the bank’s name and address.

Bank statements are usually available online through your bank’s website, making it easily accessible for tax filing purposes. If you prefer paper statements, you can request them from your bank or visit a branch to obtain a copy.

Online Banking

If you use online banking services, you can also find your bank account and routing numbers by logging into your account. These numbers are usually displayed on the homepage or in the “account details” section of your online banking platform.

Some banks may require you to go through additional security measures before displaying this information, such as entering a one-time password or answering security questions. This process ensures the safety and confidentiality of your financial information.

Contacting Your Bank

If you are unable to locate your bank account and routing numbers through the methods mentioned above, you can always contact your bank directly. An easy way to find their contact information is by visiting their website or calling the customer service number on the back of your debit or credit card.

Be prepared to provide some personal information for verification purposes before they disclose your account and routing numbers. It is always best to contact your bank during their business hours for a quicker response.

Benefits of E-filing with Direct Deposit

Now that we have discussed the importance of having your bank account and routing numbers when using tax preparation software let’s explore the benefits of e-filing with direct deposit.

Faster Refund Processing

As mentioned earlier, direct deposit offers faster refund processing compared to paper checks. This is because e-filed tax returns are processed and issued refunds much quicker than paper returns.

According to the IRS, taxpayers who e-file their tax returns and choose direct deposit can receive their refunds in as little as 21 days. In contrast, those who file a paper return can expect to wait six to eight weeks for their refund.

More Secure and Convenient

E-filing with direct deposit is also considered more secure and convenient compared to mailing a paper return. With e-filed returns, your personal information and bank account numbers are encrypted and transmitted securely, reducing the risk of identity theft or fraud.

Another benefit is the convenience of not having to visit a bank or wait for a check to arrive in the mail. Your refund will be deposited directly into your account, ready for you to use as needed.

Error-Free Returns

E-filing also reduces the risk of errors on your tax return compared to paper filing. Most tax preparation software comes with built-in error-checking tools to help catch any mistakes before submitting your return. This can save you time and potential issues with the IRS.

Additionally, since your bank account and routing numbers are entered directly into the software, there is less chance of human error when compared to writing them on a paper form.

Conclusion

In conclusion, having your bank account and routing numbers on hand when using tax preparation software is crucial for accuracy, convenience, and security. It allows for faster refund processing, ensures error-free returns, and reduces the risk of identity theft or fraud.

If you are unsure where to find this information, consult your bank statements or online banking platform, or contact your bank directly. Investing a little time in obtaining and verifying your bank account and routing numbers can save you from potential delays or issues with the IRS.

Take advantage of e-filing with direct deposit to make the tax filing process smoother and more efficient. By following these tips, you can ensure a successful tax return experience.

FAQs

When preparing your taxes, what can possibly help reduce the amount of taxes that you owe?

One way to potentially reduce the amount of taxes that you owe is by taking advantage of tax deductions and credits. These are available for various expenses such as education, charitable donations, and home ownership.

What does the w-2 form tell you?

The W-2 form provides information about your taxable income earned from an employer during the tax year. It includes details such as wages, salaries, tips, and bonuses, as well as taxes withheld for federal, state, and local taxes. This information is important for accurately reporting your income on your tax return.

What is the purpose of the w-4 form?

The W-4 form is used to determine the amount of federal income tax that is withheld from your paycheck. It allows you to specify the number of exemptions and additional withholding amounts, which can affect how much taxes are taken out of your wages each pay period.

How does the government pay for roads, schools, and emergency services?

The government pays for these services through funding from taxes. Taxes are collected from individuals and businesses in order to pay for public goods and services, including infrastructure, education, and emergency response.

This is one of the main reasons why it is important to accurately report your income and pay taxes – so that the government can continue to provide these essential services.